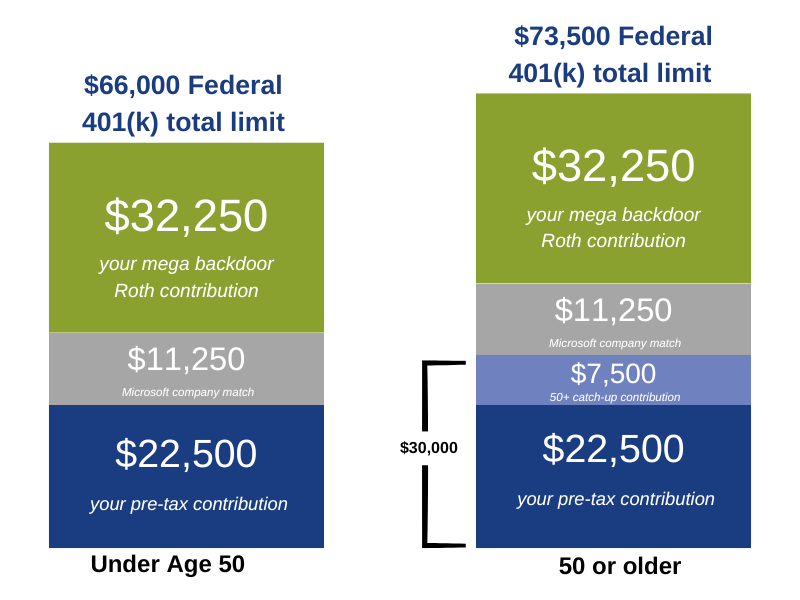

Mega Backdoor Roth 2025 Limit. The mega backdoor roth limit for 2025 is $46,000, regardless of your age. For example, if you make $200,000 per year and your employer makes a 3% match, subtract the additional $6,000 in matching contribution ($200,000 x 0.03), leaving.

Amazon Mega Backdoor Roth Sophos Wealth Management, First, make the maximum contribution to a 401 (k) plan, which may be much higher than you realize. This is likely a reference to mega backdoor roth conversions, in which a saver can convert 401(k) investments into a roth individual retirement account or roth.

Mega Backdoor Roth Definition & How It Works Seeking Alpha, This $1 million includes option. Publicly traded companies are limited to a $1 million deduction on certain covered employees (such as ceo).

Your Retirement Secret Weapon The Mega Backdoor Roth, Ep 91, Publicly traded companies are limited to a $1 million deduction on certain covered employees (such as ceo). In 2019 the maximum tax.

How Does the Mega Backdoor Roth Help You Save for Retirement? Our, In addition to your traditional or roth 401 (k) contributions (limit of $23,000 or $30,500 over age 50 for. This is likely a reference to mega backdoor roth conversions, in which a saver can convert 401(k) investments into a roth individual retirement account or roth.

Mega Backdoor Roth IRAs What You Should Know Foster Group, In 2019 the maximum tax. For people 50 and older, the limit is.

Mega Backdoor Roth My Step by Step HowTo Guide Managing FI, This is likely a reference to mega backdoor roth conversions, in which a saver can convert 401(k) investments into a roth individual retirement account or roth. In 2025, the mega backdoor roth strategy allows 401 (k) contributions up to $69,000 for those under age 50 and $76,500 for people 50+.

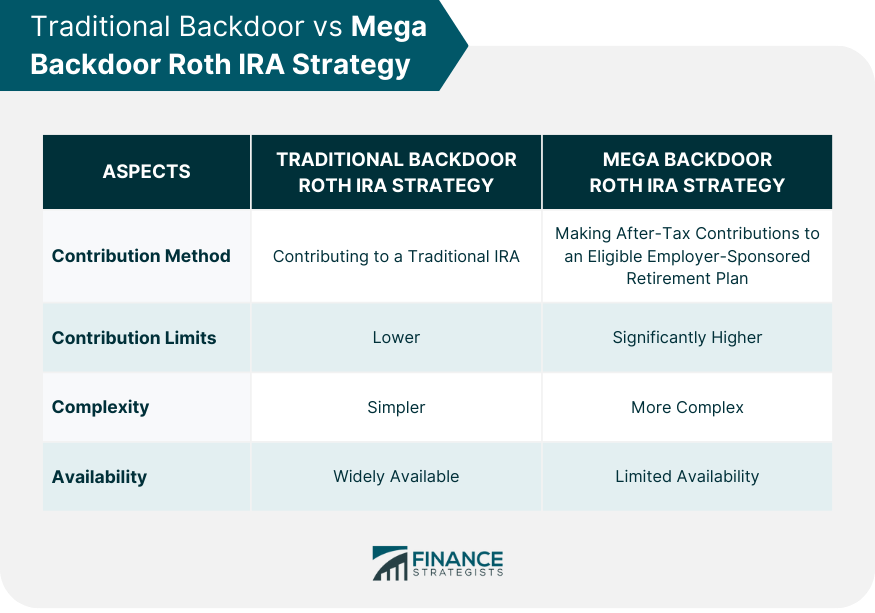

Mega Backdoor Roth IRA Strategy Meaning, Eligibility, Process, This is likely a reference to mega backdoor roth conversions, in which a saver can convert 401(k) investments into a roth individual retirement account or roth. The benefits of a mega backdoor roth.

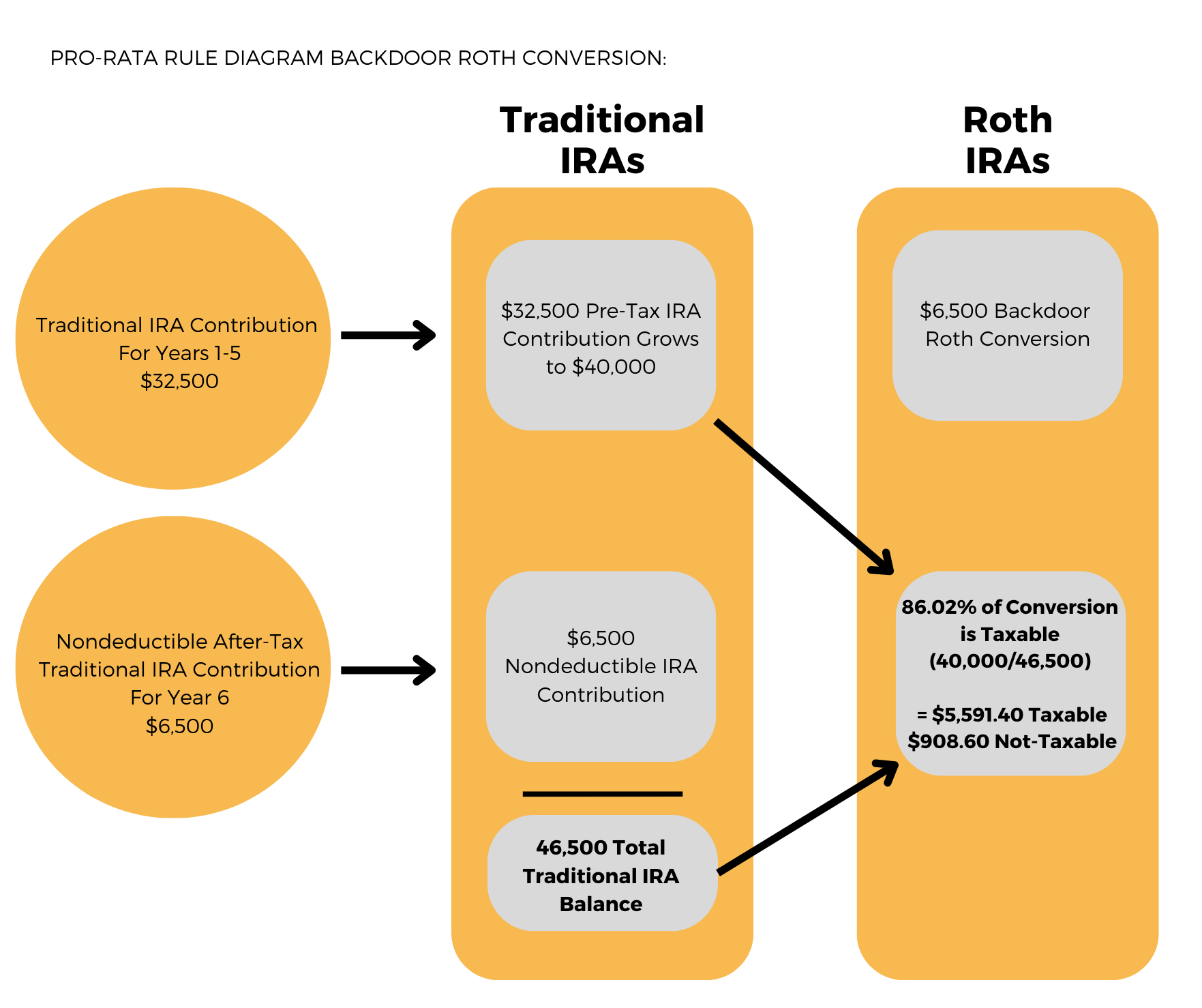

Avoid the Pro Rata Rule with Backdoor & Mega Roth Conversions RGWM, This is likely a reference to mega backdoor roth conversions, in which a saver can convert 401(k) investments into a roth individual retirement account or roth. A mega backdoor roth takes it to the next level.

Mega Backdoor Roth… Deconstructed, For example, if you make $200,000 per year and your employer makes a 3% match, subtract the additional $6,000 in matching contribution ($200,000 x 0.03), leaving. It’s for people who have a 401 (k) plan at work.

What is a Mega Backdoor Roth IRA?, A mega backdoor roth takes it to the next level. The benefits of a mega backdoor roth.

This is likely a reference to mega backdoor roth conversions, in which a saver can convert 401(k) investments into a roth individual retirement account or roth.