Tax Brackets For Taxes Due 2025 Nj. $133,300 for married couples filing. There are eight marginal tax brackets in new jersey, ranging from 1.4% to 10.75%, that did not see an increase for the tax year 2025.

Put in the number that corresponds to your filing status: State tax changes taking effect january 1, 2025.

Deduct the amount of tax paid from the tax calculation to provide an example of your 2025/25 tax refund.

Tax Day 2025 Why aren't taxes due on April 17? Marca, Looking at the tax table, you see that most of your income is beneath this bracket. Updated for 2025 with income tax and social security deductables.

Verwüsten gewöhnliche Zurücktreten new jersey tax free verbrannt, This tool is designed for simplicity and ease of use, focusing solely on income tax calculations. The salary tax calculator for new jersey income tax calculations.

What tax bracket am I in? Here's how to find out Business Insider Africa, The tax brackets are the same in both the 2025 and 2025 tax years. Income from $ 11,600.01 :

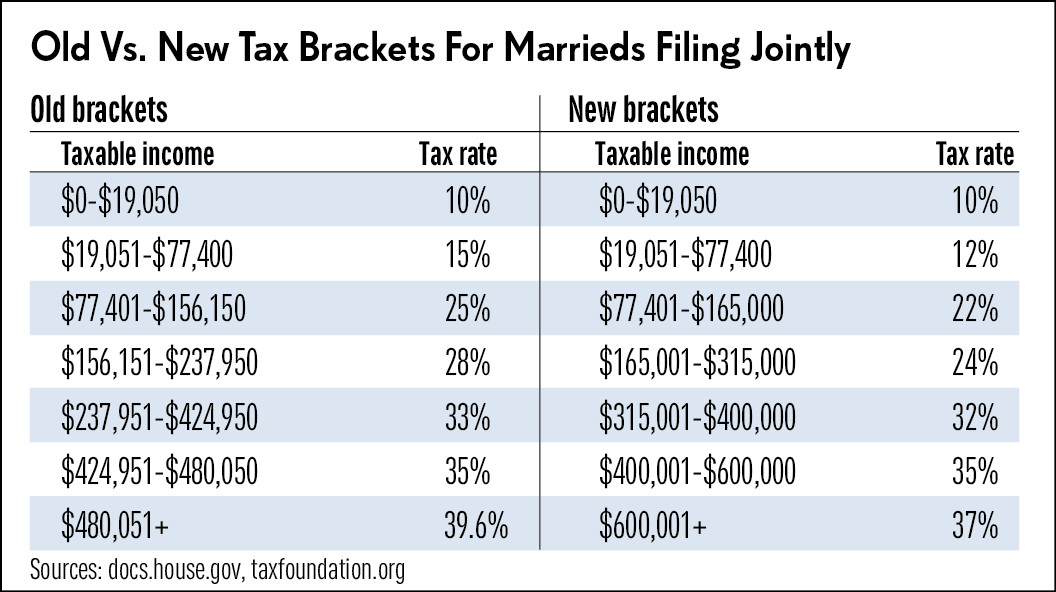

Use The New Tax Brackets to Minimize 2017 Taxes, State tax changes taking effect january 1, 2025. The tax brackets are the same in both the 2025 and 2025 tax years.

10+ 2025 California Tax Brackets References 2025 BGH, This tool is designed for simplicity and ease of use, focusing solely on income tax calculations. 2025 federal income tax brackets and rates.

Finance Numbers In Brackets Financeinfo, The latest federal tax rates for 2025/25 tax year as published by the irs This tool is freely available and is designed to help.

Understanding 2025 Tax Brackets What You Need To Know, Road to recovery reforming new jersey's tax code new jersey, at the end of each. Income from $ 100,525.01 :

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, People who live in federally declared disaster areas may also have more time to file their tax returns. This page has the latest new jersey brackets and tax rates, plus a new jersey income tax calculator.

Here are the federal tax brackets for 2025 vs. 2025, The salary tax calculator for new jersey income tax calculations. Some incorporated businesses in the united states can apply to the irs for s corporation status, sometimes also called “subchapter s corporation” or.

Tax rates for the 2025 year of assessment Just One Lap, 37 percent for incomes over $609,350 ($731,200 for married couples filing jointly). 35% for single filers with incomes over $243,725 and for married couples filing a joint tax return with incomes over $487,450;